SUMMARY

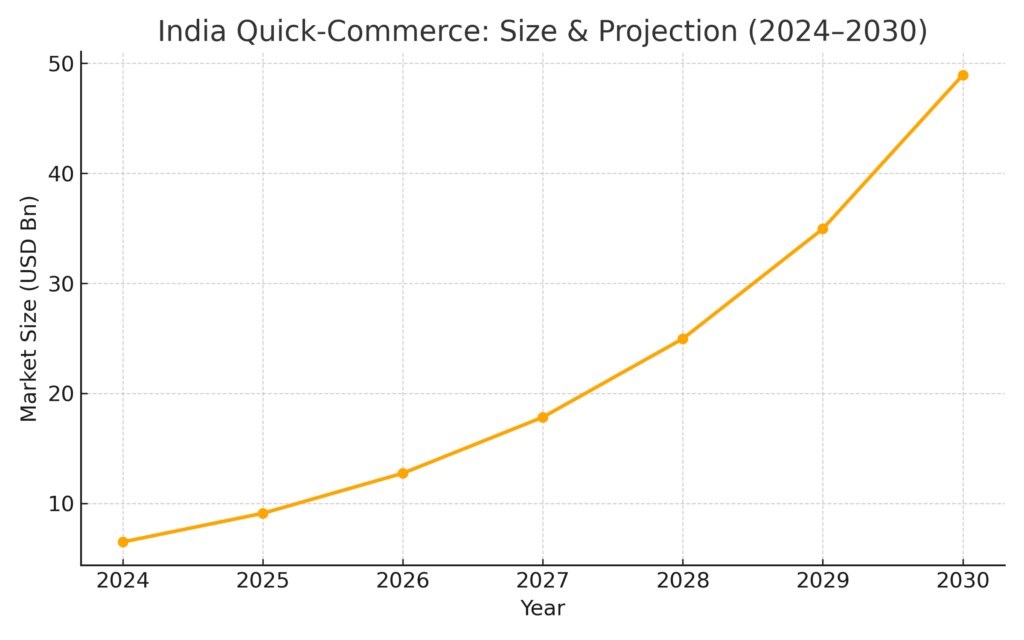

- Market size: India’s quick-commerce GMV hit $6–7 billion in 2024 and is forecast to grow ~40% annually to 2030.

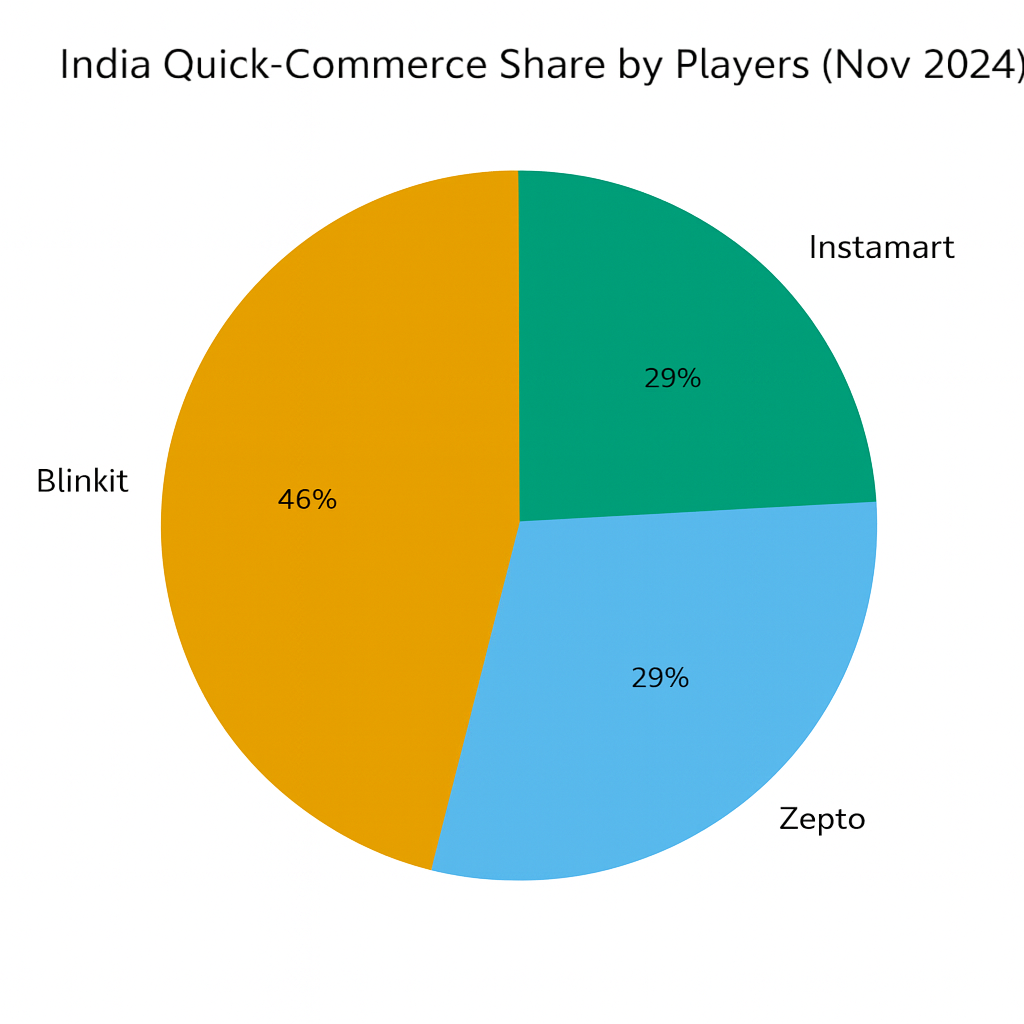

- Leaders: Blinkit has pulled ahead—>50% market share in Sep 2025—with Zepto and Swiggy Instamart vying for No. 2.

- Momentum: Zepto’s FY25 revenue jumped ~150% YoY to ₹11,110 crore. Swiggy is adding dark stores aggressively; Instamart’s GOV more than doubled YoY in Q4 FY25, though profitability remains work-in-progress.

- Shake-out: Dunzo has shut down, while Flipkart Minutes and BB Now (BigBasket) are expanding into instant delivery

How Big Is India’s Quick-commerce Market?

- Where we are now (2024): Quick-commerce accounted for two-thirds of all e-grocery orders and ~10% of e-retail spend in India, with $6–7B GMV.

- Where it’s headed: The same report projects ~40% annual growth through 2030, as platforms expand beyond groceries into electronics, beauty, and seasonal gifting and push deeper into Tier-2/3 cities.

Visual: Market size & projection (2024–2030)

(Chart rendered above using the midpoint $6.5B for 2024 and a 40% CAGR projection to 2030.)

Who’s Winning Today?

1) Blinkit (Eternal / Zomato group) — the pace-setter

- Share: >50% market share as of September 2025, up from ~46% in late 2024.

- Financial trajectory: FY24 revenue ₹2,301 crore; turned adjusted EBITDA positive in March 2024; recent quarters show sharp growth with a Q1 surge noted by Eternal. Analysts expect Blinkit’s sales to accelerate meaningfully through 2026.

- Why it’s winning: Denser dark-store network, high-velocity assortment, rising average order value (AOV), and strong cross-sell via the parent’s ecosystem. Analysts also see higher AOV vs peers.

2) Zepto — fastest climber

- Revenue: ₹11,110 crore in FY25 (≈$1.3B), up ~150% YoY from FY24’s ₹4,454 crore (audited).

- Share: Several 2025 snapshots put Zepto around the high-20s by market share (varies by city/metric), generally second to Blinkit.

- Expansion vectors: 250+ dark stores in top metros (and counting), wider catalog (45k+ SKUs), and new categories like pharmacy.

3) Swiggy Instamart — scale with margin pressure

- Growth: Instamart GOV grew ~101% YoY in Q4 FY25; Instamart revenue rose ~20% QoQ that quarter.

- Profitability watch: Contribution margin dipped in Q4 FY25 with heavy store additions, then improved to ~-4.6% in Q1 FY26 as expansion moderated.

- What to watch: Massive dark-store rollout (1,000+ by mid-2025) and category pushes (stock-up, megastores) aimed at lifting AOV and utilization.

New/returning challengers

- Flipkart Minutes: Now in ~19 cities; powering Big Billion Days with 10-minute deliveries and plans to double dark stores.

- BigBasket BB Now: Leveraging Tata supply chain but saw FY25 turnover dip amid q-com competition.

- Dunzo: Exited after a prolonged cash crunch and pivot missteps—one of the space’s first big shake-outs.

Market Share Snapshots (To Quote Responsibly)

- Nov 2024 (Motilal Oswal): Blinkit 46%, Zepto 29%, Instamart 24%. (Good baseline for a chart.)

- Sep 2025 (BofA): Blinkit >50%, with Instamart, Zepto, BB Now, Flipkart Minutes, Amazon’s offering sharing the rest. (Useful to show trend direction).

Visual: Market share (Nov 2024 baseline)

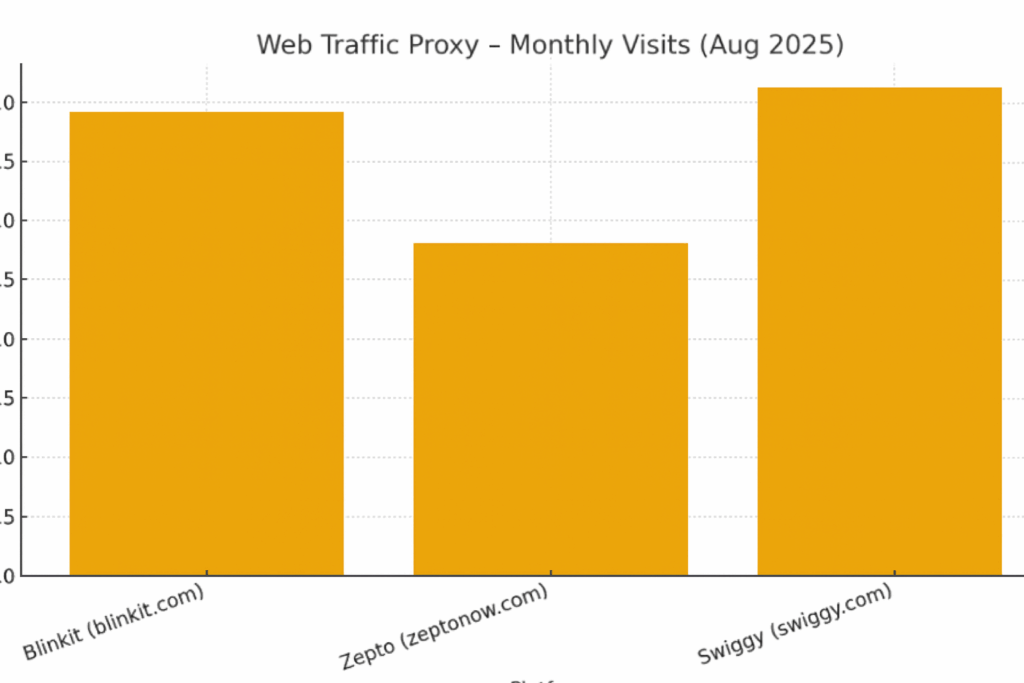

Traffic & Reach (Web Proxy; Apps Are Bigger)

Web isn’t the primary acquisition channel in q-com (apps are), but it’s a handy proxy for top-of-funnel demand:

- Aug 2025 monthly visits: swiggy.com ~20.6M, blinkit.com ~19.6M, zeptonow.com ~13.6M. (App DAU/MAU are higher but proprietary).

Visual: Monthly visits (Aug 2025)

Revenue & unit economics (company-wise)

Blinkit

- FY24 revenue: ₹2,301 crore, with Adj. EBITDA positive (Mar ’24); analysts expect steep sales ramp through 2026 and higher AOV than Instamart.

Zepto

- FY24 audited revenue: ₹4,454 crore; FY25: ₹11,110 crore (+~150%). Losses narrowed YoY in FY24; FY25 filings indicate disciplined expansion.

Instamart (Swiggy)

- GOV +101% YoY in Q4 FY25; however, ramp-up temporarily pushed contribution margin to around –5.6% before improving to ~–4.6% in Q1 FY26. Swiggy continues investing in supply chain and dark-store density.

10 Trends Defining India’s Quick-commerce In 2025

- From groceries to “everything now”: Phones, small appliances, toys, beauty, and pet care are now “instant.” Flipkart Minutes and Instamart are actively pushing electronics and event-day deals.

- Retail media inside q-com: Sponsored listings and brand takeovers are growing rapidly, following the broader e-commerce ad boom.

- Megapods & stock-up baskets: Larger dark-stores and “stock-up” flows raise AOV and utilization—especially for Instamart.

- Festival flash-sales go instant: Big Billion Days and brand launch days now run on q-com rails (10-minute delivery as a USP).

- Tier-2/3 expansion: Growth beyond metros continues, but the economics are trickier (density and demand spikiness).

- Consolidation + fresh challengers: Dunzo’s exit frees share; Flipkart Minutes and BB Now intensify competition.

- Profit discipline is back: Blinkit hit EBITDA positivity in Mar ’24; Swiggy’s guidance focuses on improving Instamart unit economics after peak expansion.

- AOV creep: Analysts forecast Blinkit AOV ~₹709 vs Instamart ~₹619 in 2026, indicating premiumization on one platform.

- Pharmacy & health: Zepto’s foray into 10-minute meds points to high-frequency, better-margin adjacencies.

- Macro debate: Some investors still question long-term sustainability in smaller cities; others see a durable channel.

Platform-by-platform Outlook (2026-2027)

Blinkit

Expect continued share gains (>50% already), deeper city penetration, and higher ad/placement monetization with larger brands. Watch for GOV and AOV outperformance; analysts model sharp sales growth into 2026. Base case: remains market leader with improving profitability.

Zepto

Revenue scale-up is real (₹11,110 crore FY25). The focus now: sustain growth while driving contribution margin towards breakeven, plus category expansion (pharmacy/beauty). Base case: strong No. 2 in many cities, occasionally No. 1 in pockets.

Swiggy Instamart

Momentum on GOV is strong; profitability will hinge on utilization of the expanded network and AOV lift via “Maxxsaver/megapods.” Base case: volatile margins near-term, improving through FY26 if store productivity rises.

Flipkart Minutes

Backed by Flipkart’s merchandising and event days (TBBD), Minutes will likely scale rapidly in cities where Flipkart has density, especially for electronics/beauty during sales. Base case: credible challenger; could force faster category expansion across the board.

BB Now (BigBasket)

Deep supply chain + everyday grocery strength remains an advantage, but q-com competition pressured FY25 turnover. Base case: targeted expansion, more selective city playbooks, retention of loyal grocery cohorts.

Dunzo

Exit complete; talent and playbooks have been absorbed into competing networks (notably Flipkart Minutes). Lesson: over-expansion + pivot whiplash can be fatal in a thin-margin game.

Risks & Watch-Outs

- Profitability vs growth: Heavy dark-store capex and promos can drag contribution margins—Instamart’s Q4 FY25 is a case in point.

- Tier-2/3 economics: Demand density and logistics costs make non-metros harder to crack sustainably.

- Category returns & shrink: Non-grocery categories (electronics/beauty) add margin but also returns complexity during festival spikes.

FAQs

Q1) What exactly is “quick-commerce”?

It’s same-hour (often 10–30 minutes) delivery from micro-warehouses (“dark stores”) located close to demand hubs—initially groceries, now electronics, beauty, toys, gifts, and more.

Q2) How big is the Indian market today?

$6–7B GMV in 2024, with ~40% CAGR projected to 2030.

Q3) Who leads the market?

Blinkit crossed 50% share (Sep 2025), with Zepto and Swiggy Instamart fighting for No. 2. City-level shares vary.

Q4) Is this profitable?

Select geographies and cohorts are profitable. Blinkit reported Adj. EBITDA positive in Mar ’24; Instamart’s margins swung with aggressive expansion but improved in Q1 FY26.

Q5) What changed in 2025?

Two things: (1) Category expansion beyond groceries (big-ticket items during sales) and (2) retail media monetization, which improves unit economics.

Q6) Why did Dunzo shut while others scaled?

A costly pivot to instant-groceries, funding crunch, and operational complexity. The market punished over-expansion without unit-economics discipline.

Q7) What to watch next?

Flipkart Minutes’ scale-up, Blinkit’s AOV and ad monetization, Instamart margin trajectory, Zepto’s pharmacy/health bets, and BB Now’s selective city strategy.